Updated on August 2023

I'm embarrassed to admit this, but I will: I daydream about multiple revenue streams. There, I said. I don't think it's because I'm a greedy bastard -- at least that's what I tell myself. It's because I'm lazy and I don't want to spend all my time making a living. I'd rather waste time making weird art with my friends.

Vending machines and laundromats are my favorite things to fantasize about. I'm sure one day I will probably dabble in both, but I'm not there yet. Given my current constraints, I don't have a ton of extra time to invest in building a new business that I have zero experience in. And I'm currently investing my extra resources into my current businesses or into the laziest, most lucrative investments out there: I invest in the stock market by buying (investing in) index funds and exchange traded funds.

The Case for Investing in the Stock Market

For any of you readers that feel resistance towards investing in the market, let's talk about it.

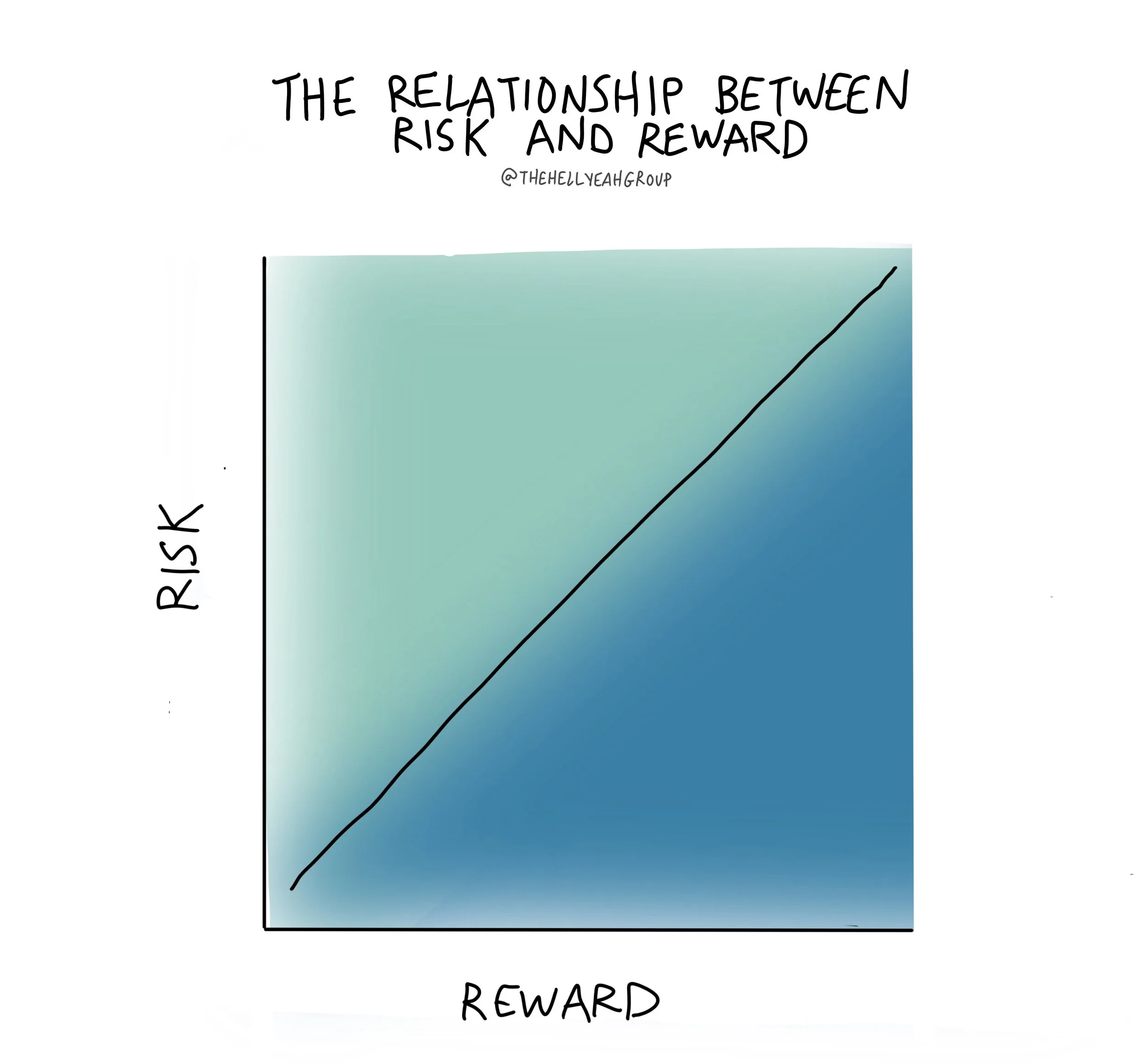

No Risk, No Reward

Let's start with the risks... Yes, investing is inherently risky. When you invest your money, there is no guarantee that you won't lose it. But when you don't take any risks, you cannot have an expectation of any reward. What does not taking risk look like? It looks like keeping all your assets in cash in checking and savings accounts.

Investing Against Inflation

If you haven't experienced rising prices yet, don't worry, kid, you will. As you get older, you'll one day have your moment of realization like... "the summer I started driving gas was 99 cents a gallon!" or "you used to be able to get a foot-long sub sandwich at Subway for $5!". If you want some real-world examples of rising prices, go ask your parents, grandparents, teachers or reddit to give you some examples.

If trying to keep ahead of rising prices isn't a good enough reason to invest, another reason is to build wealth. Building wealth is simply owning valuable things (assets) that either can be sold for cash or used to generate a revenue stream. Building wealth isn't about affording first-class and caviar, it's about having flexibility and being able to weather the inevitable economic storms that everyone eventually has to face.

When you keep your assets in cash, it's pretty much guaranteed that your $10,000 in the bank will not be lost because of FDIC insurance. However, if you keep everything in cash, even though to dollar amount never decreases, what does decrease is the value of your dollar. Why? Because of inflation.

So while the cash amount in your accounts only fluctuates if you choose to spend or not, the actual value of your cash certainly goes down over time.

The Easiest Way to Start Investing: Funds!

The stock market can be intimidating for the inexperienced beginner. One of the most common fears new investors have is how to choose investments. Choosing a company to buy stock from opens the door to a myriad of frightening possibilities.

Here's the good news: you only have to do the research on individual companies if you want to. Most investors can and do invest in already diversified investments called ETFs and index funds.

They both provide the right level of diversification and accessibility to the stock market without requiring a lot of initial capital or deep research.

ETF vs Index Fund

What are ETFS and Index Funds?

These two investment vehicles both give access to groups of stocks (and bonds) all at once. Buying them is like buying a basket of securities. Instead of going to the farmer's market and choosing which produce to buy from different farmers, it's like buying a produce box that diversifies both the produce selection and the farms they buy from.

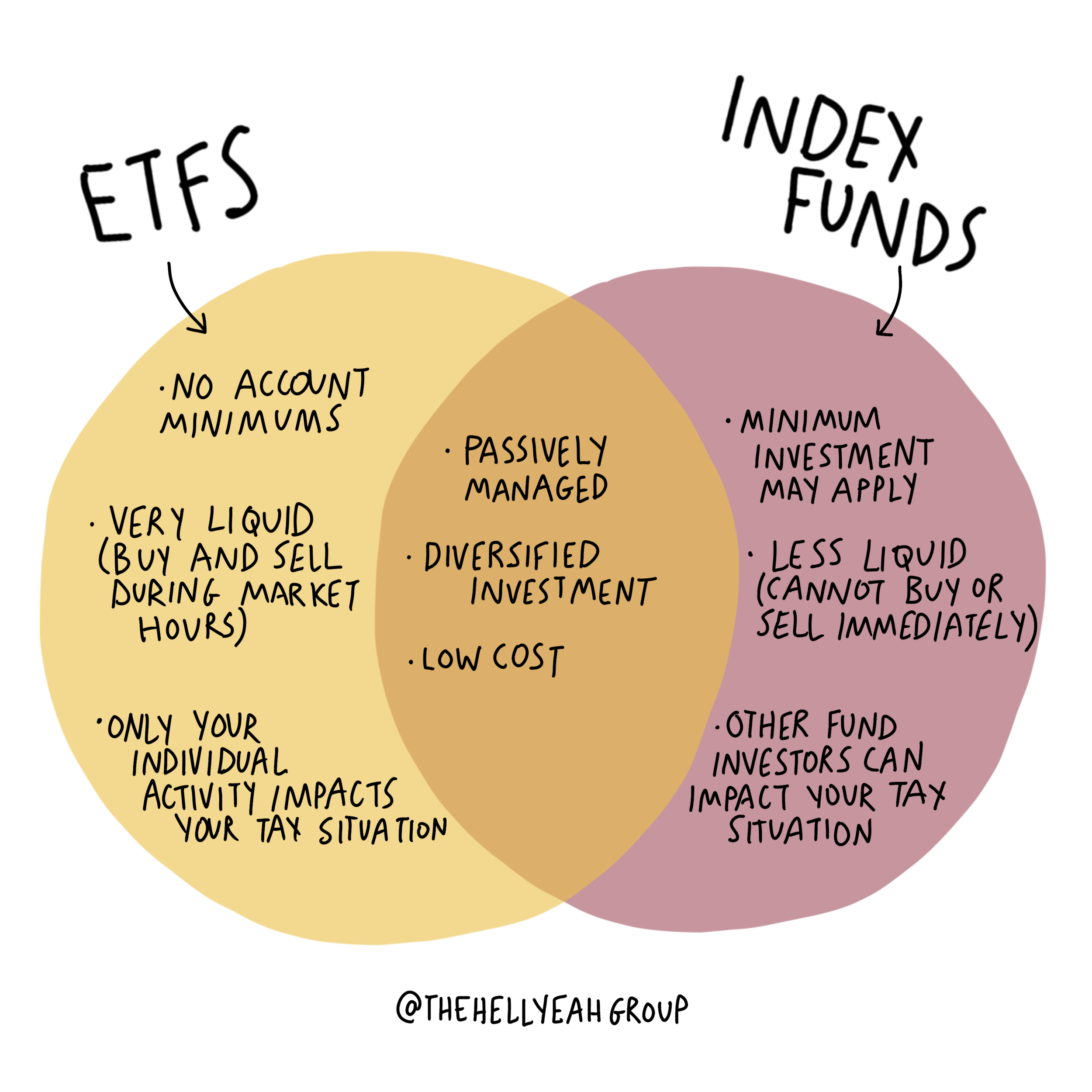

ETFs and Index funds may help you accomplish similar things, but there are some key differences between them. If you want to grow your wealth, it's essential to understand them both and decide which option is right for you.

Passively Managed Funds

At first glance, exchange traded funds and index funds appear to do the same thing. They are both passive investment vehicles, that pool money into a larger fund that tracks a specific market index.

ETFs and index funds are types of investments that are also passively managed funds because they follow the indexes like S&P 500, the Dow Jones, or another market index. By matching their holdings, ETFs and index funds act as a mirror.

An actively managed fund, by contrast is one where the investment advisor or managers pick and choose investments because they are in line with the the active fund manager's investment objectives. For example, actively managed mutual funds requires fund managers to direct its investments.

Benefits of Passive Investing

Since the fund mimics an index, there is no picking and choosing, which means no expensive mutual fund investment managers. This is one reason why the fees for ETFs and index funds are considerably lower than fees compared to actively managed investments like mutual funds.

Diversification

Compared to buying individual stocks, index funds and ETFs are less volatile because these types of funds provide a simple, easy way to diversify your portfolio. By simply purchasing shares of an ETF or index fund, you are buying more types of investments because you're pooling your money with lots of other investors.

Minimum Initial Investment: ETF vs Index Fund

If you're new to investing or only have a small amount you're willing to invest, you might be more attracted to ETFs. Since they are traded like normal stock shares, you typically can invest however much you'd like. Even if you can't afford a full share, many brokers allow you to purchase fractional shares. These fractional shares allow you to buy as little as 1/100,000th of one share in some cases, meaning you can invest exactly as much as you want. In short, there really is no minimum investment.

Some index funds, however, have minimum investments high enough to deter some investors. Vanguard's popular index fund requires $3,000 up front. Others like Fidelity and Charles Schwab have no minimum initial investment requirement.

If you're working with a small fund, you can make ETFs or index funds work, just be sure to investigate the minimums before making an order.

Fees and Expenses: ETF vs Index Fund

Some investors don't consider the cost of upkeep when they put their money into an ETF or index fund. The good news is that they are both extremely cost efficient compared to actively managed funds.

Charles Schwab, for example, offers both a broad market ETF and an S&P 500 index fund. These investments require expense ratios of .03% and .02% respectively, meaning that for every $10,000 you have invested exchange traded fund, you will be annually required to pay out $3.00 for the ETF or $2.00 for the index fund.

Consider that these funds often return 10% or more annually, these numbers are largely ignorable, but still worth knowing before buying in.

Another consideration are commissions and trading fees. If you use a stockbroker that charges commissions, you'll pay every time you buy or sell ETF shares. Some index funds also charge commissions, so do some research before buying in.

Lastly, some ETFs entice new investors by waiving initial fees. Should the waiver expire, fees can creep in without you realizing. If you want to protect yourself against this happening, you can research information within an ETFs prospectus.

ETFs and index funds are bought and sold differently

Exchange-traded or index mutual funds are named for their relationship with the stock market. Unlike most index funds though, ETFs can be bought and sold at any point that markets are open during a regular trading day, just like individual stocks.

Index funds, however, can only be bought and sold once per day, after regular trading hours. You can put an order in, but don't expect to get filled immediately.

For long-term and passive investors, this isn't likely to matter much. If you don't plan to pull your investment for ten years, a slight dip isn't expected to make enough of a difference to be worth the trouble.

Taxes: ETF vs Index Fund

When you decide you're ready to cash out on an ETF, the process is simple. You sell your shares on the open market just as you would individual shares of stock. Of course, you'll have to pay capital gains taxes on any profit you make, but the taxation ends there.

Index fund taxation is a little more complicated. When you want to cash out on your index fund, the manager will have to sell assets to gather the cash to pay you with. If that sale is a profit, the capital gains taxes are issued to everyone with investments in the fund.

Which is better index fund or ETF?

I got started investing with $25 so the decision of whether to invest in an ETF or an index fund was made for me since ETFs have no minimum investment requirement. The other reasons folks choose an ETF over an index fund is because they intend to buy and sell them more actively. However, just because you can do that doesn't mean that you have to.

ETFs are also ideal for those who want to invest in a specific niche market or industry, as index funds generally only follow broad market trends with no specificity beyond overall performance.

If you have enough to meet the minimum requirement for an index fund and you are looking for a totally hands-off passive investment strategy and experience, you might find that the simplicity of index funds makes it the most attractive choice. Put your money in index mutual fund bit by bit for retirement or any other later expense and don't worry about it until it's time to pull your investment.

However, sometimes the type of account you have (retirement or brokerage) or investment platform you choose may dictate whether or not you pick ETFs over index funds or vice versa. For example, a platform like Betterment only offers ETFs and some retirement accounts that invest in target-date funds may only invest in index funds.

The decision to invest in an ETF or index fund doesn't have to be an either or decision. You might choose index funds for your retirement account, while investing in ETFs within your brokerage account.