Do you know how much it costs your business to earn each dollar it makes? Unlike traditional employees, when you're a self-employed service provider, every dollar you earn has a cost beyond your time and energy. How much do you need to pay for employee payroll, taxes, operating costs like marketing and insurance, profit, and personal pay?

Even if you’re a one-person freelance practice, understanding how much it costs you to earn each dollar in your company is a valuable shift in perspective that can help you build a sustainable, efficient business.

What is a cost revenue ratio?

Cost revenue ratio is a tool. It measures how each dollar you spend creates revenue for your company, and it can help you have a more robust understanding of your business. For example, a business owner with a cost ratio of 50% spends $50 to generate $100 in revenue.

It's not as complicated as it might sound, especially if you have been tracking financial data and keeping clean books via bookkeeping. We can measure your business's cost ratios by analyzing a few data points from your business’s financial reporting

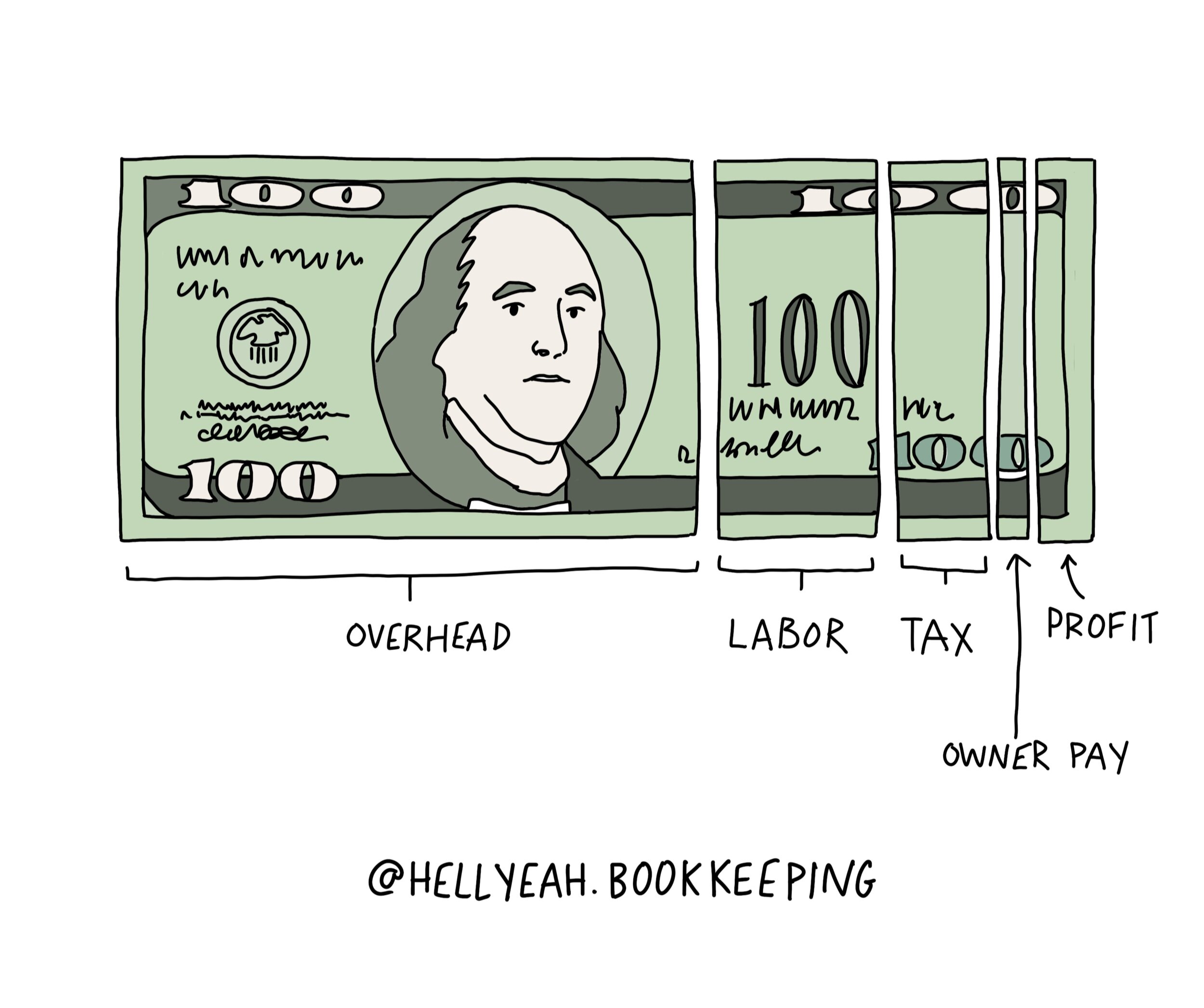

True understanding of how every dollar your business earns gets spent is best expressed by calculating expenses as ratios or percentages.

Why calculate percentages? Can't we just look at the data in dollars and cents?

It's essential to look at these figures as ratios or as percentages because it allows you to understand income, expenses, and profit relatively. In other words, if you know that your salary is generally 12% of total gross revenue (income before taxes), that means roughly $12 of every $100 your business earns is your personal pay. You can use that data to scale up, to forecast, and to imagine how much an increase in total gross revenue could impact your salary. You could even work backward if you have a salary goal in mind.

Ratios also make it easy to compare your business to other businesses and benchmarks within your industry without compromising privileged financial data.

You can calculate cost revenue ratios

Let's start by analyzing the following categories: your total operating costs, your labor costs, your pay, and your profit.

A couple of caveats:

Technically, from an accounting standpoint, your profit isn't a cost. It's what's left over from revenue after you pay expenses. Depending on how you pay yourself, your pay may not also be a cost; again, this is from a technical accounting perspective. But to understand how each dollar you earn gets allocated/spent, or the flip side, how much it cost you to make every dollar, we're going to look at them through the lens of this ratio.

Folks with product-based businesses should also analyze their company's cost of goods. But for the sake of simplicity, I'm leaving this category out.

Let's look at your annual totals.

For the last twelve months, run your profit and loss statement to get the totals in each of the categories.

Total annual gross revenue

This is your company's revenue before taxes.

Total annual labor costs

This total includes contractors and employees, including payroll taxes. These costs should be all the labor costs that directly generate revenue.

Total annual operating costs

This is the total for all operating costs that aren't directly related to generating income.

Total annual owner pay

If you aren't counting this already in total labor costs and depending on how you pay yourself, this might not show up on the profit and loss. It may be on the balance sheet or you may need to simply look at the transaction data to find how much you paid yourself.

Optional, but recommended: Total annual income taxes

You can choose to include the income taxes that you, the business owner, pay on your income and the business's profit in your total owner pay. Remember, kids: LLCs and S-corps don't pay taxes at the corporate level, those taxes pass through to the individual business owners. Chances are you're like the majority of small business owners and your business paid you so you could pay your taxes.

Alternatively, you can break this tax number out. To find if, you can refer to your tax documents or simply by asking your accountant.

To calculate each cost revenue ratio, you can use this formula:

Cost revenue ratio = cost of revenue / total revenue

Here's an example

Frankie runs a production company called Frankie Creative. Here’s a breakdown of their annuals:

Total annual gross revenue: $1,300,000

Total annual labor costs (contractors and employees, including payroll taxes): $350,000

Total annual operating costs: $400,000

Total annual owner pay: $250,000 (this includes $70,000 that went towards what Frankie owed in personal income taxes)

Total annual profit: $300,000

Here are Frankie's ratios:

Labor ratio: 27%

$4000,000 / $1,300,000 = 0.2692 0.2692 x 100 = 27%

Operating cost ratio: 31%

$350,000 / $1,300,000 = 0.3076 0.3076 x 100 = 31%

Owner pay ratio: 19%

$250,000 / $1,300,000 = 0.1923 0.1923 x 100 = 19%

Profit ratio: 23%

$300,000 / $1,300,000 = 0.2307 0.2307 x 100 = 23%

So we can look at those ratios in dollars again to understand for every $100 Frankie's business earns, it costs them $27 in labor, $31 in operating expenses, $19 that gets paid to Frankie personally and $23 in company profit.

We could also look at it like this if we break out the personal income tax piece:

Labor ratio: 27%

Operating cost ratio: 31%

Owner pay ratio: 14%

Income taxes: 5%

Profit ratio: 23%

Let's scale these ratios up.

For every $1,000 Frankie's business earns, it costs them $270 in labor, $310 in operating expenses, $140 that gets paid to Frankie personally, $50 for income taxes they'll owe on that pay, and $230 in company profit.

Pro Tips:

All of these ratios added up should equal 100. So, add up your final list and make sure you got all the math right. The point of this exercise is to give you another perspective. It's not the only way to understand your business's financial picture, just another lens to view it through.

Calculate the cost ratios that are most important and applicable to your business; some, not all, might be enough.

Revisit the ratio

It's a good idea to revisit your ratio every year, if not every quarter. Reviewing regularly ensures that nothing in your business is getting out of balance, especially when your income fluctuates. If this ratio is like checking the vitals of your business, you’ll know quickly if there’s more to investigate or if everything’s humming along as expected.

Let's say that costs generally begin to rise because the economy is growing and experiencing an inflationary period, your operating cost revenue ratio might jump out at you and signal ways to either reduce expenses or raise your rates, or both. When you look at your ratios regularly, you'll have a shorthand for understanding how your business is doing. You’ll be well-positioned to make adjustments before it’s too late.