Small Business Articles

A Christmas Carol tells the story of Ebenezer Scrooge’s redemption. Our main character, Scrooge, starts as a cranky old man who hoards his wealth, treats his employees like garbage, and bums people out with his bad vibes and lack of generosity. Throughout the story, we bear witness to Scrooge’s transformation. He is visited by the ghosts of Christmas past, present, and what is yet to come. These spirit guides help Scrooge slowly gain clarity on who he has been and wants to become.

Through these visions, Scrooge recognizes the error of his ways, and by the end, old Ebenezer finds the willingness to change. If you haven’t read Charles Dickens's novella, I’m sure you’ve seen some version of it. Some old 90’s sitcoms have used this same framework to help the hero of a story emerge on the other side a better, more aware version of themselves.

Weirdly, the work we do at Hell Yeah Bookkeeping is a bit like this story. Thankfully, our clients aren’t cranky old misers. Instead, they tend to be insightful, creative business owners. And they need our help to become better, more aware captains of their company. In perfect conditions, we take our clients through a similar, but less dire, Scoorge-like journey where the ghost of business-past, business-present, and business-future all help our heroes have clarity and inspire a change to be better business owners.

Here are all the lessons I’ve learned from all the business owners with whom I’ve had the pleasure of working. They helped me build my sustainable business first by being paying customers, but I’ve also had the unique viewpoint of watching them grow their businesses from the inside out. Watching and playing a tiny, supporting role in other people’s success has been really fun.

I spent most of my young adulthood and late teenage years playing in bands with my friends. But it all started with a simple question.

One day, a classmate who eventually became one of my best friends casually asked, “Do you want to start a band?” Surprised and intrigued, I asked her what instrument she played. She said something about taking piano lessons as a kid.

“Well, do you want to learn how to play the bass?” I thought about the cheap, $ 40, midnight blue electric bass guitar I begged my dad to buy earlier that year from a stranger selling it on Craigslist. “I have one you could use.”

“Yes,” she said with the kind of confidence reserved for youth, “Definitely,”

I took the bass to school the next day. As I handed it to my friend, not realizing how this little action would seal our fates and friendship for decades, we agreed to have our first practice later that week on the last day of our junior year of high school.

We’ve played together for years. On and off. And in different projects. We still tinker around to this day. Throughout all the years playing together, we learned our instruments, made lots of mistakes, and even more memories – like the great tequila embargo of 2014.

As the years accumulated, I wondered how playing hundreds of shows and writing countless songs would fit into the bigger picture of my life. Starting a band is a lot like starting a business.

Even though my constitution will always require playing and making music for the sake of silly art and self-expression, I also learned many invaluable business lessons along the way. Here they are in no particular order.

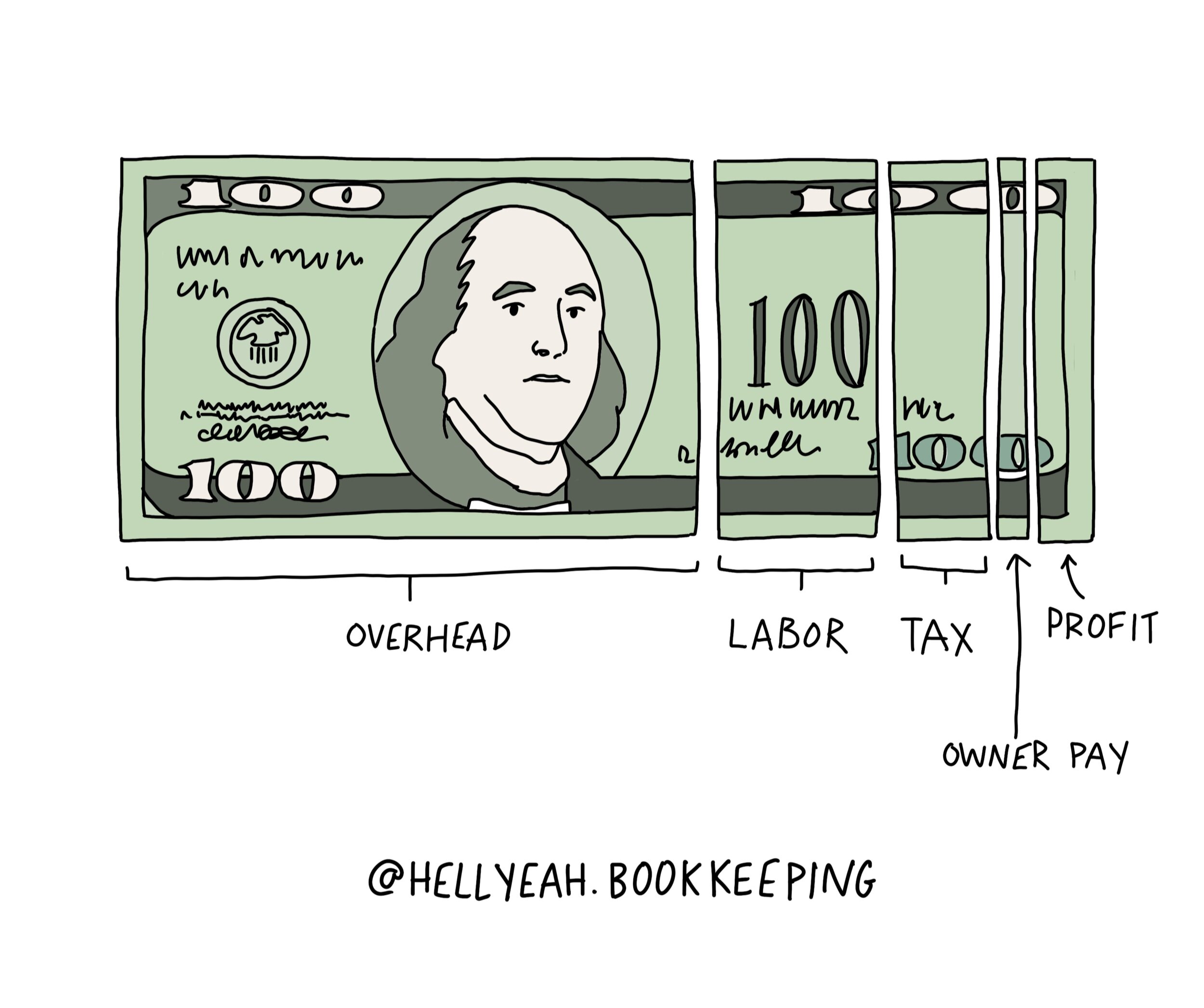

Do you know how much it costs your business to earn each dollar it makes? Unlike traditional employees, when you're a self-employed service provider, every dollar you earn has a cost beyond your time and energy. How much do you need to pay for employee payroll, taxes, operating costs like marketing and insurance, profit, and personal pay?

Even if you’re a one-person freelance practice, understanding how much it costs you to earn each dollar in your company is a valuable shift in perspective that can help you build a sustainable, efficient business.

What makes tax season so stressful for most small business owners and freelancers? I think it can be chalked up to a few things. First, if you haven’t kept up with your bookkeeping, then you’re facing a year’s worth of accounting homework with a fast-approaching due date. If you don’t know how much you’ve made, you can’t know how much you’ll owe in taxes - you’re flying blind and that’s scary.

So you’ve discovered that tax saving wonder known as the S Corp. You’re ready to start kicking the tires by learning what this “Reasonable Salary” thing is all about. Let’s discuss what it means, why it matters, and the best way to find yours.

A reasonable salary for an S Corporation's shareholder-employee is the part of their compensation that must be treated as employee wages. The IRS requires you to be paid an appropriate wage for the services you provide your corporation because provides needed funding for Social Security and Medicare. It’s best to work with an experienced tax professional to set your optimal reasonable salary, but this article will be a great primer to get acquainted with what a reasonable salary is.

By Pamela Rosario. Three ways legalizing your business will save you money in the long run.

Here are six things I've learned since deciding to start a business six years ago. A lot has changed since then. One glaring change is that I don't even offer the service I originally offered. And as of late, I mostly feel like I'm a writer, but maybe that's the season my business and I are in or the fact that I've spent the last six months writing a book.

Here's what I've learned about pricing over the years of running my own business and being the kind of person who thinks an awful lot about money.Sell value, not time.When you can sell the value you are creating for your customers; you can charge a lot more than if you could charge on time alone. Should an expert cobbler who has 45 years of shoe-repair experience charge less because he can fix your shoes faster and better than a rookie? Hell no. What is the value of continuing to use that pair of shoes you bought for $299 and plan to keep for the rest of your life?

It’s been over 4 years since I’ve gone off my own and I’ve learned more about the world and myself in this short amount of time than I think I’ve learned in my whole life - at least it feels that way. Now that my business is no longer a sketchy house of cards that could fall down at any moment, it’s a lot of fun making things exist in the world to help people.

Here are twelve small truths that I’ve learned while forging my own path.

When you’re at a bar at 1am; you’re not drunk, but not not sober, surrounded by a bunch of friends, the last thing you want to do is load several heavy, oddly shaped items into a car only to have to unload them shortly after. This is the worst part about playing in a local band; you have to do everything yourself… but it’s just part of it. It comes with the territory.

To my freelancer friends and small business buddies who hate selling or pitching or talking about the money part of things. I get it, it sucks, but too bad. It’s the trade off for being able to spend your working life building something you believe in. It’s the cost of mostly being in charge of your life. Talking about money doesn’t have to suck. You can stop hating it, but you have to do some work to change your own perspective on it.

Here are some ways I think about selling. I hope some of it will light up your brain and help you power past some of your limiting beliefs around selling and talking to customers about money.

Picture this. You’re back in 5th grade. You’re standing in a line with your fellow classmates, facing an open field. And you’re all about to be humiliated because you’ll now be ranked by your kickball skills.

There are two team captains and they’re staring you all down and sizing you up. The first picks start and of course, the kids with the most kickball skills are picked first. Then the kids with the moderate skills are picked. They don’t even need hard kickball skills, they can have skills like morale building, being a team player or not getting in the way of the star players. And then the last picks are the kids who might not only lack skills; they might be a liability. On the dusty field, it’s not about feelings or friendships, it’s all about skills. After all, it’s not called friendship ball.

My favorite dad-joke about being a freelancer or small business owner is how we end up getting jobs that we never applied for.

No matter what you do, when you first start out, you do it all. You’re the head of marketing, the VP of sales and the director of finance.

If you’re in business, and you’re a little lost on what you need to be doing to stay on top of your finances, here are the things you should be looking at every week to make sure your business will be sustainable in the long run.

If you've never had an year-end tax planning meeting with your accountant it could be because you have a very "easy" tax situation. For example, you're a single, renter who has a salaried job, with no side hustles or dependents. Easy. You don't really need a tax planning meeting because you're paying taxes as you earn your income.

What is venture capital?

Venture capital (VC) is funding given to businesses from investors.

It’s called venture capital funding because it’s funding from the specific investors known as venture capitalists.

Investment from venture capitalists can be more than money. In addition to cash, VCs often invest in the form of technical or managerial expertise. It’s not their first rodeo, so they can impart some wisdom.

Accounting is a process of sorting financial data. Through sorting the data, the accounting process creates products. The products are reports. These reports are useful to the management team, business owners and shareholders or investors. The reports also play a pretty vital role in helping your accountant file your taxes.

You don’t need to do a lot of digging to determine whether or not your business is doing well. You can feel it by just observing the day to day operations. When you’re able to pay all your bills, pay yourself and your employees and you have money left over in your business, it’s pretty obvious that things are going pretty swimmingly.

But instead of flying by the seat of your pants or letting your socials statistics determine the health of your company, let’s observe some factors that will allow actually you to determine the health of your business. There are a variety of measurements to choose from. They range from simple observations to more complex ratios.

If you work for yourself or dream of working for yourself, I'm sure one of the motivating factors is to make a profit. Making a profit can depend on a lot of different factors. Some of those factors are outside of your control like the market and the competition. You can move the needle on other factors like leadership, management, location and the number of locations. But one of the most important factors that have a direct impact on your profit is pricing. Pricing is how much you charge for your service.

I scream, you scream, we all scream for payroll!

If you're an employee who has ever gotten a paycheck, getting paid is a pretty awesome feeling. As an employer, payroll is pretty damn costly. It tends to be the biggest expense for most businesses and not just because of the actual cost of salaries. There are taxes too. Payroll can have complexity and any missteps may cost you. According to an IRS report, roughly 40% of small businesses incur an average of $845 per year in IRS penalties for errors with payroll tax filings and payments.

Ladies, gentlemen, non-binary friends and humans of all identities, yes you can tidy up your finances. Sí se puede, guys. Trust me. And once it's there, it's all about maintenance. Getting there could require some effort and energy, but it's worth it. Gone will be the days of you expending mental bandwidth thinking about an old 401(k) account you know you should rollover but you haven't.

One of the first concepts I learned while studying economics is a phrase made popular by the economist Milton Friedman: "There is no free lunch". An Econ professor once wrote it on the white board in all caps and it's stuck with me ever since.

You've probably heard your accountant or that one friend who totally has their shit together talk about how you should be saving for retirement in an IRA. And like a good adult, you probably make all the right noises at the right times to suggest you understand what the hell they're talking about. In case you've been living a lie because you don't really know what the hell an IRA is, I'm here to free you from the shackles of your own confusion.

So let's go balls deep into the non-sensical world of IRAs.

Here are my predictions for what’s in store in 2024 and what that means for creative businesses. They’re a result of reflecting on the last year, observing larger trends and chatting with folks across various creative industries, from creators who make money on social media to to small business owners, artists, and folks in the podcasting industry. A lot of this may be anecdotal, but some of these patterns are worth paying attention to. Let’s dig in.