Bookkeeping isn't that fun. Seeing how much money your business made and watching profitability grow can be fun. But the actual act of accounting is mildly satisfying, at best, and frustrating to the point of tears, at worst. Even though bookkeeping software has become user-friendly, you still might end up making costly mistakes if you don't have some accounting chops to help you understand how to troubleshoot and fix things.

It's probably time to outsource your bookkeeping if any of the following are true:

You've tried to set up your chart of accounts, only to quit after getting stuck deep inside a Google hole.

You can't figure out why the bank balances don't match, and so you never reconciled your accounts.

Your business is doing so well that you don't have time to sit down and focus on the bookkeeping.

When it comes to hiring a bookkeeper, here are your options: you can hire a freelancer, a firm, or an employee. The person you hire should have bookkeeping experience. They should either be a bookkeeper or an accountant. All bookkeepers do bookkeeping, but not all accountants do bookkeeping.

Hiring a Freelancer

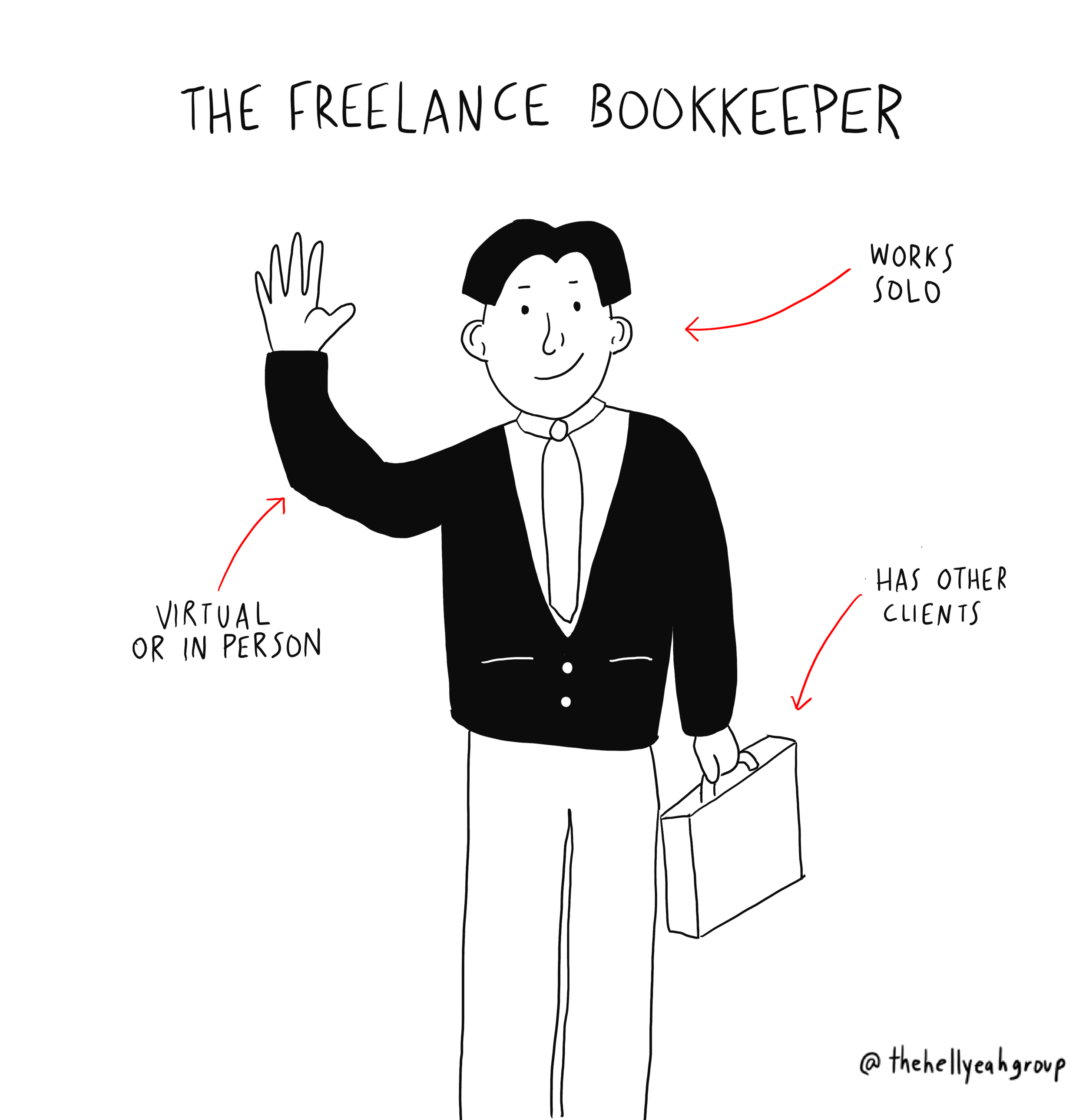

A freelance bookkeeper will be the most affordable option for outsourcing your bookkeeping. Freelancers will mostly likely charge lower rates than firms because they'll have lower overhead. You can expect them to charge you an hourly rate (in the range of $25 - $85) or a flat rate. The big drawback of hiring freelancers, is they set their schedules, so your bookkeeper may not be available every day. Also, since freelancers are lone wolves, there is some risk that if they have an emergency or become too busy with work, you could experience interruptions in service.

If your business finances are simple, a freelancer is a great option. Some freelancers work in person so that they can come to your office or home office. Still, it's becoming increasingly standard for bookkeepers to work virtually, especially if your business is already pretty paperless. Most new accounting software is cloud-based so that all bookkeeping work gets done remotely. Hiring a remote freelancer is another way to keep costs down.

Finding a freelancer who has experience in your specific industry can help reduce the potential for any costly, avoidable mistakes. Even if a freelancer has certifications or several years of experience, accounting for different industries varies. For example, a wholesale produce business is going to look a lot different than a plumbing service. If a freelancer has many clients in the same industry, that institutional knowledge compounds and can end up bringing a lot more value than a freelancer who has to learn about your industry from scratch.

You can find a freelance bookkeeper by asking other people and businesses in your industry for referrals, check your industry associations, or ask your accountant. You can also find freelancers on Upwork.com or through bookkeeping platforms, like QuickBooks Pro Advisors or Xero Advisors.

Hiring a Bookkeeping Firm

A bookkeeping firm is a company that employs many bookkeepers. Hiring a firm is generally more costly than hiring freelancers since businesses have a higher overhead to maintain operations. You can expect firms to charge an hourly or flat rate for bookkeeping services, just like freelancers.

If you are worried about not having a bookkeeper you can rely on every day, a firm is a good option for you. You might have more than one point of contact or another bookkeeper who can jump in to assist you if yours is on vacation or sick. Generally, there is a bit more support and less of a service gap when you hire a firm, but that support and peace of mind tend to come at an extra price.

Cloud-based accounting software allows bookkeeping firms to work remotely, avoiding travel time and, ultimately, reducing the overall cost of bookkeeping to their clients. Bookkeeping firms have had to hone in and build a reliable workflow to work remotely with multiple clients. You might find that their process and workflow is something you'll need to adapt to.

Bookkeeping firms also employ different levels of bookkeepers, from entry-level to expert, and with varied industry experience. So firms have a wealth of knowledge that freelancers may not. Industry experience can help reduce avoidable errors, but diverse expertise can also give bookkeepers insight they might not otherwise have. Some firms that handle bookkeeping also might provide tax services so that you could have it all under one roof. If they don't, they'll undoubtedly have experience working directly with accountants and can give you a referral for an accountant they can vouch for.

You can find bookkeeping firms by asking other people and businesses in your industry for referrals, check your industry associations, or ask your accountant. The old Google probably has some great resources too. If you're a creative agency in the market for bookkeeping services, check out my firm, Hell Yeah, Bookkeeping.

Hiring an Employee

Some businesses need more support than what a bookkeeping firm can provide. Hiring an in-house bookkeeper is the most cost-effective and efficient solution for companies that have more than $1 million in revenue and 30 employees.

Business owners will have much more control and complete oversight of the entire bookkeeping and accounting process with an in-house bookkeeper. According to Glassdoor.com, in-house bookkeeping salaries range from $33,856 to $65,000 - that's the cost before payroll taxes, employee benefits, insurance costs, and the extra costs incurred to train a new employee. If a full-time bookkeeper is too expensive for your business, you may consider hiring a part-time bookkeeper.